Estate & Inheritance Planning: Why there is no wealth, only life

18th November 2019

-

Jonathan Orchard See profile

‘There is no wealth but life. Man is richest who has the widest helpful influence, both personal, and by means of his possessions, over the lives of others.’ John Ruskin.

The title above is a quote from John Ruskin, who was a supporter of the arts, social reformer and conservationist in Victorian Britain. I recently visited his beautiful home on the shore of Coniston Water in the Lake District.

His words reflect what is essentially at the heart of estate planning, because this is the aspect of financial planning where – either during your lifetime or through your death – your wealth is passed down to others, be they private beneficiaries such as family and friends, or other causes.

The 100-year life

In my experience people often underestimate their lifespan. I recently read the book The 100-Year Life by Lynda Gratton & Andrew Scott, which looks at the ever-increasing life expectancy and explores the challenges and intelligent choices that all of us, of any age, need to make to turn greater life expectancy into a gift, rather than a curse.

If John Ruskin was right and there is no wealth but life, we are off to a good start – we’re getting richer all the time!

At Old Mill, before considering Inheritance Tax (IHT) planning or passing wealth onto the next generation, we first have to ensure that you have enough to live a comfortable and meaningful life. Only after this has been addressed can we then consider your assets, and your thoughts on passing wealth on to others.

Planning for Inheritance Tax

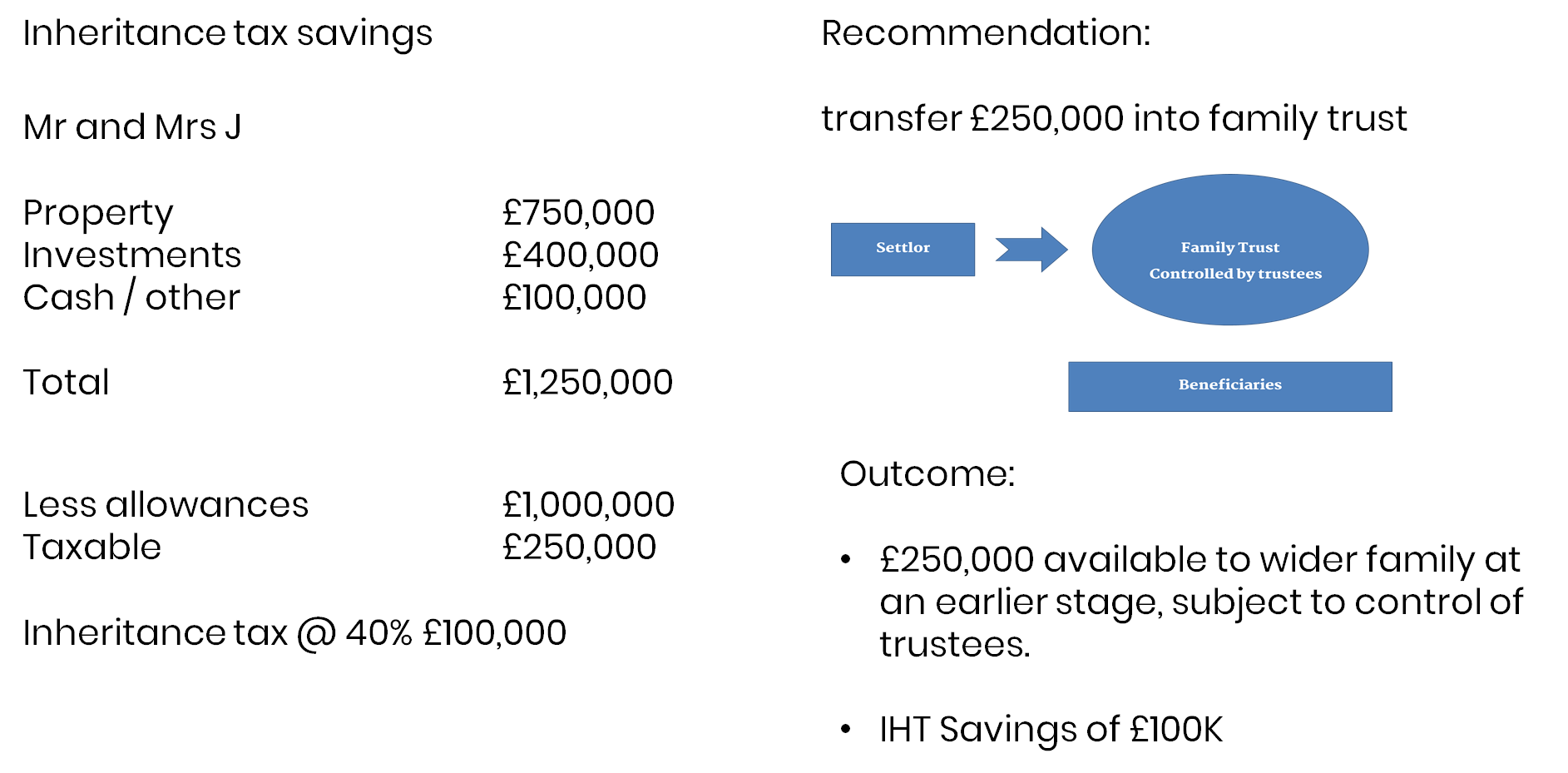

The starting point is to make sure that you have a will that’s up to date and reflects your wishes. One option we you can then explore is the use of trusts. These allow the owner of an asset to distribute or donate it to another person, group or organisation, without giving them control of it, so long as it remains in trust.

You might wonder why, if you were giving money or property to somebody, wouldn’t you want them to have full control of it? There are as many answers to that question as there are types of trusts. One common reason is that you may want to put money into a trust fund for children or grandchildren, but you suspect that giving youngsters control over a large sum of money may not deliver the results you were hoping for.

There are plenty of misconceptions surrounding trusts and their uses and, as a result, many people are unaware of just how beneficial they can be. Trusts are not only for the exceptionally wealthy, they are useful in a number of scenarios.

Philanthropy – preserve of the billionaires?

Leaving money to family and private beneficiaries may not be everyone’s intention. There are some really interesting causes to support, and indeed tax breaks for philanthropic giving.

The word ‘philanthropy’ usually brings thoughts of billionaires such as Bill Gates or Warren Buffett. But you don’t have to be a billionaire to make a real difference. You may have a cause close to your heart: supporting the young, old, the church or the arts. If not, there are many national charities and local community foundations that can help you to determine the causes you wish to support.

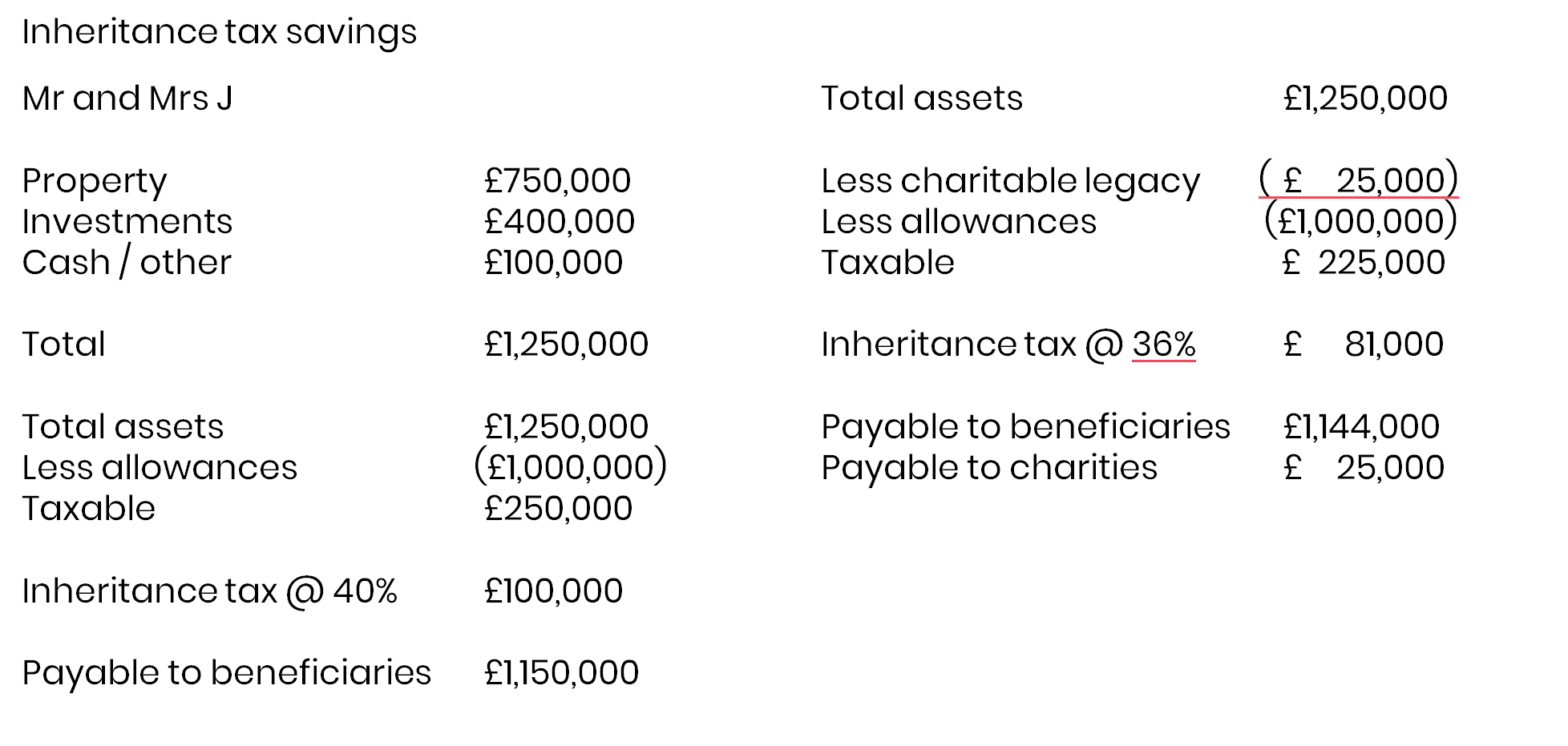

Gifts to charity in your will could mean a 10% reduction in IHT

If you leave at least 10% of your net estate to a qualifying charity it may reduce the amount of IHT paid by your estate to 36% instead of 40%. However, certain factors need to be taken into account. The net value of your estate is the value of your taxable assets less qualifying debts, exemptions, nil-rate band and any other reliefs or liabilities, and a qualifying charity is one recognised by HMRC that has been granted a charity reference number.

The rules are complicated in all but the simplest circumstances, so feel free to talk to us if you want to introduce this feature into your estate planning.