Growth assets

High inflation and higher interest rates are not all bad and there are certainly some investment sectors, for instance Banking, where higher interest rates mean greater profits.

Since the beginning of the year, two funds in the growth part of portfolios have made the biggest impact.

7th July 2023

-

Gavin Jones See profile

US equities have driven much of the returns in equities this year so far meaning in your portfolios, the Legal and General International Index fund has been the standout performer with growth of over 8%.

After some large falls in 2022 some of the biggest stocks are showing large returns this year. Meta (Facebook) is up 138%, Tesla has more than doubled, and Nvidia, the chipmaker is up by 189%.

At the other end of the scale has been global commercial property (e.g., shopping malls, offices, industrial buildings, logistics hubs and data centres). We include this asset class in the growth assets portion of portfolios to provide diversification to your equity exposures.

Of late, global commercial property has been under pressure on account of lifestyle and work-pattern changes, driven in part by covid lockdowns. Add in rapidly rising interest rates and the ‘story’ sounds quite bleak. In 2022 the asset class was down by around -14%, whilst the UK equity market was up by about +7%. It is down again in 2023 by just under 5%. Some may be tempted to consider abandoning it as an asset class, as the future ‘obviously’ looks bleak, and its recent run of poor performance is thus likely to persist. Yet this is to ignore a central tenet of systematic investing that all this doom and gloom is already reflected in market prices for global commercial property. It may go higher or lower from here, not because of what has recently happened but what new information the market receives. Take a look at the chart below.

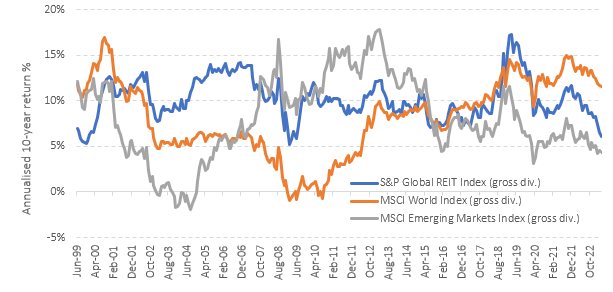

Figure 1: Every asset class has its bad and good periods (rolling 10-year returns)

Data: Morningstar Direct © All rights reserved

The graph shows the annual return over rolling ten year periods for each of global developed equites (using the MSCI World index), emerging markets and Global REITs (Real Estate Investment Trusts). It is evident that each of the three has had better and worse times and – over this period – global commercial property has been the most consistent with an annualised return of no less than 5% a year while the other assets have seen periods when the ten year return has been negative. A rational investor might reasonably want to own all three in some proportion. Abandoning or adding to a portfolio simply by extrapolating what has recently done well or badly is not a great strategy and is likely to lead to constant portfolio change, less-well diversified portfolios and poorer outcomes.

If thinking that the recent past somehow presages future outcomes and picking what has just done well and avoiding what has just done badly, is a winning strategy, then investors who follow this path are likely to be disappointed.