Looking to the past and then to the future

Throughout 2022, we were reminded that investing is not easy. Investors have enjoyed around a decade of relatively strong and consistent market returns, even in the light of a global pandemic. Last year, however laid bare the fact that investing can very much be a game of ‘three steps forward and one step back’.

16th January 2023

-

Gavin Jones See profile

Risk is part of investing in the pursuit of higher returns for if there was no risk of market downside, it would be unreasonable to expect any return at all above the rate of interest earned on cash. This short piece provides a brief look at the past 12 months and highlights some of the lessons we can learn as investors.

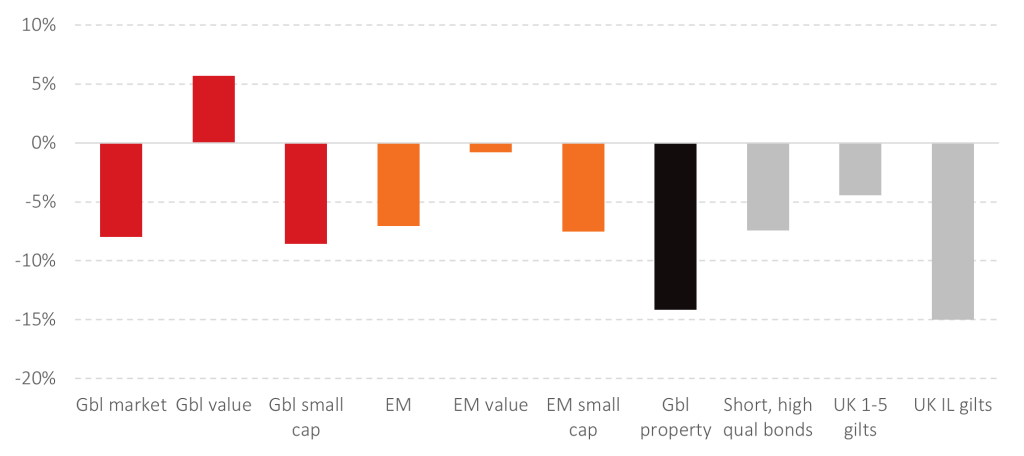

For many investors, 2022 was challenging, with returns ranging from benign to poor across most major asset classes – global developed value companies being an exception. Rising prices make investment returns significantly worse on an after-inflation basis, with year-on-year inflation in the UK having reached levels not seen for decades. The year was particularly challenging for investors in bonds, as yields have risen (and thus prices have fallen) across much of the world. Bondholders, in particular, with longer and lower quality debt suffered greater capital falls. Shorter dated, high-quality bonds that predominately make up the bonds held in our portfolios suffered lower falls and continue to be our preferred choice for the majority of the bond investments held in our portfolios.

Figure 1: Global investment returns – sensible assets 2022 returns

The chart below shows the investment returns of asset classes used in your portfolios.

Source: Albion Strategic Consulting, Funds used to represent asset classes, in GBP (January 2023).

With few places to hide, most investors will have finished the year in negative territory, which can be expected from time to time. The magnitude of the losses, however, lie well within the range of returns that can be expected from portfolios. Investors with a reasonable amount of equity exposure should be able to withstand more material falls than those experienced in 2022 (global equities fell by over 40% during the Credit Crisis, for example). That said, those investors overweight in value companies and focusing on shorter-dated bonds will find themselves in a better position than most, though this is of little consolation when returns are still negative in absolute terms. Investing is never a straight-line journey.

Investors with portfolios denominated in sterling (GBP) have benefited from the strong performance of the US dollar, which has meant overseas assets translate back to more in GBP terms. In US dollar (USD) terms (which is often reported in the press) global equities fell around 18% in 2022, around 10% more than when viewed in GBP terms. Some of the major US firms like Tesla and Meta have hit the headlines with share price falls of over 70% and 60% respectively in the past year. However, they only represent a small allocation in our portfolios and thus have a small impact overall.

The asset class that uncharacteristically stole the headlines (for all the wrong reasons) was fixed income or bond investments as they are often referred to. Many bond indices which measure the performance of different classes of fixed interest investments experienced their worst calendar year on record. This was chiefly due to the unforeseen and persistent high inflation that arose last year and the corresponding rise in interest rates from central banks. This resulted in bond prices falling and yields rising to reflect higher interest rates. This has meant absolute falls for fixed income investors which is, something that few investors will have seen in a year when equities fell also. The last time this happened was 1994.

The reality however is that higher yields are a good thing for investors going forward. Today, 5-year gilt yields stand at 3.5%, as opposed to -0.1% at the start of 2022. Bondholders start 2023 in far better shape from an expected return perspective against 12 months ago.

Uncertainty often abounds. Basing investment decisions on forecasts or judgments is generally best avoided. After setting out his column’s 2023 predictions, Robert Armstrong of the Financial Times, questioned Do I have high confidence in any of this? ‘Heck no’ was his answer. There is no shortage of seemingly sensible predictions out there on market performance and global developments[1], but equally there is no effective method to assess the accuracy of these so called predictions.

Investors should therefore look to the future with the anticipation that new information will come to light, and markets will react quickly to take it into account. Given it is impossible to predict the future, the answer is to construct a diversified portfolio built to weather all storms, supported by an ever-increasing body of academic evidence. If for example, inflation or growth come in higher or lower than expected, some parts of the portfolio will by design be helping, and others detracting from performance. That is what diversification does.

[1] Armstrong provides a list of outlooks from several significant market participants: https://www.ft.com/content/7803704f-8161-4af8-b9b5-1a7ccd5c2cba

News outlets have a bias towards reporting bad news, which is hardly surprising as bad news sells.

Nicholas Kristof of the New York Times plainly states that journalists ‘report on planes that crash, not planes that land’ and writes[1] a column on some significant achievements made by the human race in 2022. For example, solar power is now on track to overtake coal as the world’s leading power source in the next five years. Time away from day-to-day news can help one feel more positive or reading information from news outlets such as Good News Network®[2] can be a refreshing exercise.

From an investing perspective, we are hopeful for the best in 2023 and beyond but remain prepared for the worst.

[1] https://www.nytimes.com/2022/12/31/opinion/2022-good-news.html

[2] https://www.goodnewsnetwork.org/