Major change to company size thresholds and audit requirements

The landscape of financial reporting for small to medium enterprises (SMEs) in the UK has undergone some significant changes. On 18 March 2024, the Conservative government unveiled a series of deregulatory measures aimed at simplifying financial reporting for businesses by raising the company size thresholds. These changes are designed to reduce the complexity and burden of legislative reporting requirements, making company compliance easier.

The Labour government are in favour of the above and have published new legislation regarding this. The changes in company size thresholds will be effective from 6 April 2025.

13th January 2025

-

Laura Seaward See profile

Key changes announced

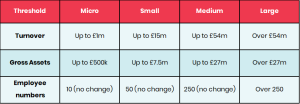

From April 2025 the size thresholds that determine the classification of companies have increased by 50%. The new thresholds are:

Two out of the three thresholds must be breached for two consecutive reporting periods when determining the company’s size.

What does this mean for business owners?

Only medium and large companies require an audit and generally speaking, most companies meeting the ‘micro’ or ‘small’ definitions can claim audit exemption.

The proposed changes mean that approximately 13,000 companies which were previously classed as ‘medium-sized’ will now fall into the small company regime and will be able to benefit from audit exemptions and can prepare simpler company accounts (using FRS 102 1A for smaller entities rather than requiring full FRS 102 accounts).

A further 113,000 estimated companies will also now be classified as ‘micro-entities’ rather than small and can prepare even simpler accounts under FRS 105, easing the overall reporting process.

However, it’s worth noting that there are circumstances where an audit may be required for a small company, such as being part of a group, or an audit being required by the company’s bank or shareholders and the changes in audit thresholds may not necessarily mean an audit is not required moving forward.

Should I claim audit exemption?

Although claiming audit exemption will reduce your compliance fees, it’s worth weighing up how claiming audit exemption could impact your business. An audit lends credibility to financial statements and stakeholders such as lenders, suppliers and customers will find the company a much more attractive proposition if the accounts have been audited and are externally verified.

An audit also educates you, as business owners, by identifying weaknesses in internal controls and reduces the chance of misreporting or fraud.

Another area to consider is if you are planning a restructure or considering exiting the business in the next few years, perhaps by a sale? The extra credibility provided by an audit, alongside highlights made by an audit of improvements that could be made to systems and controls, will really add value.

Directors should weigh up the benefits of reducing compliance fees (reducing audit fees) against the value of voluntary audit.

Here to help

As always, it is good advice for businesses to stay informed about regulatory changes and consult with their advisers. For further details and assistance, feel free to reach out to Old Mill. We can talk about the implications of the changes in the audit thresholds and help you decide what is best for you and your business.