Managing investment risk

Our Investment Committee, which is responsible for the ongoing oversight of our investment solutions, spends much of its time managing the investment risks we take rather than managing a solution based solely on what has performed well in the past. Well understood, and tightly managed risks should be compensated accordingly.

Our risk-focused approach to investing ensures that the risks inherent in a portfolio are understood allowing investors to form a reasonable expectation about the investment journey they may experience and the potential performance of their investments.

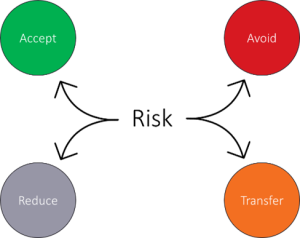

There are four choices when it comes to managing risk: accept, avoid, reduce, and transfer. We explore these in turn below.

4th October 2024

-

Gavin Jones See profile

Accepting risk means to accept the uncertainty that one understands to be present in an opportunity. Decades of academic research and data insights have helped to build a solid foundation of evidence from which investors can develop an understanding of what it means to accept certain risks. Some risks our Investment Committee chooses to accept are listed below – this list is by no means exhaustive:

Stock market risk: owning a diversified basket of stocks enables investors to benefit from the rewards capital markets can bring. It is well understood that stock markets provide an efficient mechanism through which savers can partake in the growth of companies from around the world by owning a small slice of each. This does not come without uncertainty (risk has two sides – upside and downside) and can lead to significant and protracted declines. It is therefore crucial for investors to understand how much stock market risk – or any risk for that matter – they can bear.

Emerging market risk: it is reasonable for investors to own a portion of their stock holdings in companies that are listed, and perhaps operate, in developing economies – coined ‘emerging markets’. Such economies can be highly productive and generate a significant proportion of global output. Risks within these economies, such as state control, corruption, or poor accounting standards, to name a few, imply that there exist greater risks of stock ownership in these economies relative to more developed economies. As such, accepting a considered amount of emerging market stock risk gives investors the opportunity to benefit from the upside that these markets have to offer.

Another choice when it comes to managing risk is the decision to avoid a risk. Avoiding unwanted risks can be as rewarding as accepting desirable ones. Those drawn by the bright lights of good performance may find themselves guilty of accepting unwanted risks, which can reveal themselves at another often inopportune time. An example of a risk we avoid is liquidity risk.

Liquidity risk: having access to your capital as and when it’s required – without having to sell at fire sale prices is important. For this reason, we only include liquid markets and asset classes in your portfolio, such as publicly traded stocks and bonds.

Some risks we want to accept might come part and parcel with unwanted risks, unless they are mitigated appropriately.

Stock-specific risk: by accepting ‘stock market risk’, investors have the opportunity to share in the growth of wealth that capital markets allow. However, by holding a small selection of stocks in companies, outcomes will be dominated by stock-specific risk. An investor owning just a few different stocks might be heavily impacted by a case of corporate fraud, for example. These things can, and unfortunately do, happen. Thankfully, the evidence provides investors with an effective tool to reduce stock-specific risk: diversification. By owning stocks and bonds from different sectors and countries from around the world whilst avoiding overconcentration in individual companies. This risk can be greatly reduced.

Perhaps the more abstract but equally important choice an investor faces with risk is the decision to pass the risk onto another party that is willing to accept it, usually at a cost. Few things in life are free!

Overseas bond currency risk: Bonds can make up a significant proportion of portfolio investments but owning bonds that are denominated in different currencies from governments and companies around the world is an effective way to improve portfolio diversification. Given bonds are owned in the portfolio as an insurance policy against equity market trauma, these bonds are typically of higher quality and shorter term. Without transferring or ‘hedging’ currency risk, the outcomes of overseas short-dated high-quality bonds are instead dominated by currency movements. Therefore, bonds in your portfolio are hedged back to the local currency which helps avoid the unwanted impact of currency volatility on bond prices.

Figure 1: The choices faced by risk managers

Source: Albion Strategic Consulting

Any investment opportunity should be judged first and foremost on its risks, rather than its performance. This leads one to assess the quality of a solution on its structural integrity. In the context of financial planning, understanding risk is crucial to ensure that you have the capital you need to achieve your goals. This is why our Investment Committee considers itself to be a risk manager, and not a performance manager.