New rules for the tax treatment of double cab pick-ups

The recent budget has announced that most double cab pick-ups will be classified as cars for Employee Benefits and Capital Allowance purposes from April 2025. As such, most double cab pick-ups will be classified as cars for Employee Benefits and Capital Allowance purposes from April 2025. Previously, these vehicles were classed as commercial vans. If a vehicle is classified as a ‘commercial vehicle’ by HMRC, it enjoys additional tax advantages over vehicles which are not classed as commercial vehicles (i.e. cars).

The new rules affect any vehicle purchased or leased after 1 April 2025 for companies, or 5 April 2025 for unincorporated businesses**, it does not affect any current vehicle already used by an employee before this date. Transitional rules also allow for any vehicle ordered before 1 April 2025, but delivered after this date, to continue to be taxed under the old rules. There is a general cut-off date of 5 April 2029 after which any double cab pick-up will come under the new rules.

**For benefits in kind the relevant date is 6 April

Let’s break down what this can mean for your business.

5th December 2024

-

Chloe Talbot-Swain See profile

‘Most’ rather than ‘all’

Firstly, it is worth noting the HMRC commentary “…most double cab pickups are expected to be classified as cars when calculating the benefit charge. This is because typically these vehicles are equally suited to convey passengers and goods and have no predominant suitability.” Due consideration should now be taken on the tax treatment of double cab pick-ups with advice sought where it is unclear what the position is prior to purchase or entering into a lease agreement.

Definition of a double cab pick-up

Double cab pick-ups are automatically categorised as Light Commercial Vehicles (LCV). Other vehicles must meet additional requirements for them to be deemed an LCV, this includes having a minimum payload of one tonne. However, the payload is the gross vehicle weight less unoccupied kerb weight so care is needed when calculating the payload of a vehicle.

Benefit in kind

For the benefit in kind updates, the only date that applies is 6 April, irrelevant of whether your business is incorporated or unincorporated. Currently, double cab pick-ups are treated as LCVs when calculating employee benefits, which caps the benefit in kind value at a flat rate.

However, as cars are subject to a tax charge based on a sliding scale in relation to their emissions, the benefit in kind value could be up to 37% + 4% for the worst polluting diesel vehicles.

The numbers

For a Euro-6 compliant £55,000 double cab pick-up with high emissions, the old benefit in kind value would have been capped at £3,960 + £757 for fuel = £4,717.

The new benefit in kind value could be up to 37% of the list price = £20,350.

If private fuel continues to be provided the benefit in kind value of providing the vehicle would rise by a further £10,286.

Capital Allowances

These currently state that a double cab pick-up with a payload of at least one tonne is treated as a van. This means that the business can claim Annual Investment Allowance (AIA) or First Year Allowance (FYA); this provides a business with 100% tax relief in the year of purchase.

If a double cab pick-up is purchased or a hire purchase/lease agreement is entered into on or after 1 April 2025 (6 April for unincorporated businesses) then for tax purposes the vehicle will also now be treated as a car regardless of its payload.

There are transitional arrangements which apply for Capital Allowances where expenditure is incurred on a double cab pick-up post 1 April/6 April under a contract entered into before those dates. These vehicles will still be treated as commercial vehicles for Capital Allowances purposes for expenditure incurred before 1 October 2025.

For cars Capital Allowances of Writing Down Allowances (WDA) can be claimed at 18% if the vehicle has CO2 emissions of 50g/km or less; or 6% for vehicles with CO2 emissions over 50g/km.

The numbers

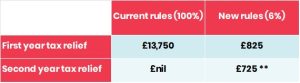

Let’s take the same £55,000 double cab pick-up with high emissions, for a company paying 25% Corporation Tax.

** It will take over 60 years to get full tax relief at this reducing rate

Value Added Tax (VAT)

The good news is that there is currently no update to the VAT treatment for double cab picks-ups; meaning as long as they have a minimum of one tonne payload these vehicles will be considered as ‘goods vehicles’ enabling VAT registered businesses to reclaim the VAT on the purchase. If the vehicle has less than one tonne payload then the vehicle will be deemed a car, and the business will be unable to claim the VAT.

The main takeaways

- The benefit in kind will increase post April 2025 making double cab pick-ups more expensive for employers and employees.

- For Capital Allowances, purchases post April 2025 will have the tax relief spread out over a longer period of time rather than being in the year of purchase, so cash flow planning will become vital.

- There are currently no updates to the VAT rules for double cab pick-ups.

Get in touch

At Old Mill, we are more than happy to lay out the options of your proposed purchase and run you through the figures and pros and cons of your options. Please do not hesitate to contact us, click here…