Old Mill Investment Committee update

An important role of the Old Mill Investment Committee is to continually review our approach to investing and the positioning of the portfolios to enable us to consider any changes we think may be beneficial to the overall investment experience.

When constructing an investment portfolio, there are certain key decisions that need to be made around the assets and the funds we use. We wanted to share some of the discussions we have been having and we will follow up with more detail on changes we will be making to portfolios in next month’s edition.

The detailed processes that underpin the construction of our portfolios coupled with our investment philosophy mean the portfolios are not subject to frequent changes. Through our regular reviews and the work of the Investment Committee, we are able to ensure the portfolios remain an effective and robust investment solution.

We share below the key areas of discussion from the most recent Investment Committee meeting.

5th May 2023

-

Gavin Jones See profile

Relevance of the UK Stock market

We have discussed previously that sometimes investors choose performance comparisons that may not be appropriate. One of these we often come across is the comparison of portfolios to the FTSE 100 stock market index. The FTSE 100 measures the performance of the largest 100 firms listed in the UK and is frequently quoted in the papers and media outlets. The comparison when used to gauge the performance of equities is loosely correct, as global stock markets are reasonably well correlated so if the FTSE 100 is going up it may well be that our growth assets and therefore portfolio values are going up also.

Over the last few years, the FTSE 100 has been one of the better performing stock markets, largely due to its exposure to energy stocks – BP and Shell as an example which have benefited from the increase in oil prices after the Russian invasion of Ukraine. However, the UK exposure is only part of the growth asset exposure in portfolios and with pressure on other areas, most notably the fixed interest securities (which form the defensive assets in portfolios) some investors have been disappointed to see falls in their portfolio when comparing against a rising FTSE 100 index.

It is important to remember however that the FTSE 100 is not representative of the constituents of your portfolio as it only measures the performance of 100 UK companies and is pure equity based which makes it very high risk. Your portfolio on the other hand consists of both global equities and also bond investments which provides a very different level of risk and investment experience. The FTSE 100 is not reflective of how our portfolios perform – it’s apples and pears.

Investing in the UK

We use asset allocation to choose the investments that will contribute beneficially to your investment journey over time. Successful investing is about taking on assets with ‘good’ risks that deliver a positive contribution.

Historically, investors have favored companies listed in their home country as opposed to those overseas. This home bias was partially down to the additional cost, complexity, and unfamiliarity of investing overseas, although these hurdles are relatively negligible nowadays.

For some time, we have had an overweight in UK stocks which we have been steadily reducing. The UK stock market forms about 4% of the global total but currently makes up about 19% of growth assets in our portfolios. Whilst we have had this overweight since the portfolios began, it is not an overexposure to the UK economy. Most large UK companies will derive much of their profits from overseas, so the exposure in reality has always been largely global. The Investment Committee has been considering if we should maintain this overweight position.

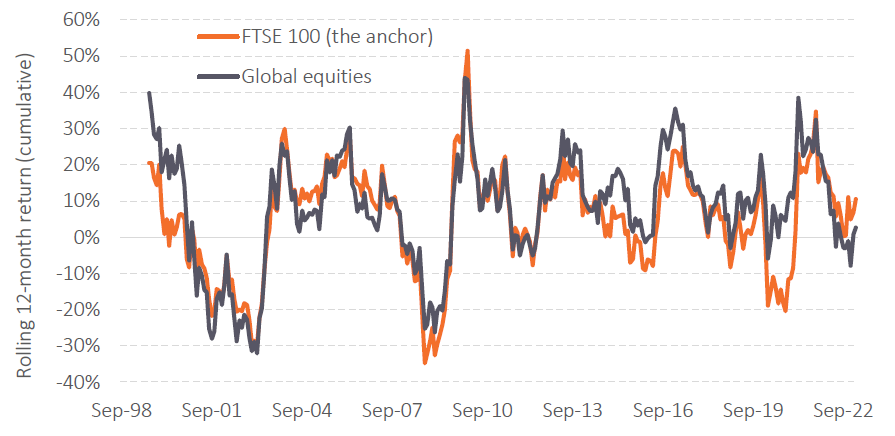

The chart below looks at the shorter period returns of the FTSE 100 and global developed equities. Overall, the return has been reasonably correlated as you can see from the shape of the graph below. Rolling annual returns show the recent outperformance of the FTSE 100 as highlighted above but also that there have been other periods of underperformance, notably during the pandemic

Rolling 12-month returns of the FTSE 100 and global equity markets

Data source: Morningstar Direct © All rights reserved. Funds: HSBC FTSE 100 Index Fund, Vanguard Global Stock Index Fund.

When reviewing which assets to include in portfolios, it is important to balance both performance and risk considerations. Although the FTSE 100 index has performed strongly in recent years, there are some very sensible reasons why having too many eggs in the 100 largest companies in the UK makes little sense from an investment portfolio perspective:

- The FTSE 100 is highly concentrated with over 33% of the assets held in just the top 10 companies – the likes of Shell, HSBC and AstraZeneca being the top holdings at present

- The FTSE 100 is materially overweight to certain sectors such as energy (12% vs 5% globally) and underweight to the point of almost not having any in terms of technology (1% vs 21% globally)

- This explains much of the recent performance differential above – where technology has struggled, energy stocks have flourished in the high-inflation environment exacerbated by the Russian invasion of Ukraine

- Over longer periods technology stocks have dominated (Apple, Microsoft, Tesla etc.)

- Investing into global stock markets more broadly means your portfolio consists of over 10,000 companies across over 50 countries against 100 UK Companies in the case of the FTSE 100. Diversifying across them all as a starting point makes good sense and should lead to a smoother investment journey.

On reviewing the allocation to global stocks, it seems a sensible decision to move more closely to the global market, as measured by the relative stock market value of each country. This will give your portfolio more diversified exposure to profits from large global companies without the current concentration to a handful of large UK stocks.

The Investment Committee also discussed the defensive assets held in Old Mill Portfolios and the impact of recent inflation and high interest rates on those assets.

Inflation persists

The recent inflation report for March added to the concern with UK inflation staying in double-digits at 10.1% and therefore far from the Bank of England’s 9.2% February forecast. Although price pressures remain, economists remain confident that inflation will soon fall sharply thanks in part to the sharp rise in the Ofgem price cap in April last year.

Fixed Interest markets are currently pricing that interest rates will peak at around 5%, implying three further 0.25% hikes in the Bank of England base rate. The next Monetary Policy Committee (MPC) meeting is next week, and it is expected we will see a 0.25% hike at that meeting.

Bonds and base rates

Investors, including professionals, sometimes convince themselves that they know what the future holds and seek to position their portfolio to benefit from that knowledge. As we have often said in past editions of Insight, this is not a game we play when it comes to investing your portfolio. We believe supported by evidence that global markets work well and the price of an asset on any given day is efficient and fair based on the information known. Any attempt to second guess this price is really nothing more than speculation.

When it comes to bond investments, bond investors know that central banks use them as a tool to try to control inflation. Therefore, the market already has an expectation of what the future interest rates will be, which is then reflected in current bond prices. Betting against the market view of future interest rate changes and how this may impact on bond prices can be very risky.

Why own bonds?

Sometimes investors can question why we own bonds. When your portfolio is growing the allocation to ‘boring’ bonds can seem like a drag on the gains you see in the growth part of the portfolio. It can help to go back to first principles to understand why an investor owns bonds in the first place. The reasons are simple:

- They are far less volatile than equities – particularly shorter-dated, high quality bonds. If equity markets fell by a half – which they have done from time to time – then bonds, even if they fell marginally would help to support overall portfolio values. In the recent pandemic, global equities (as measured by the FTSE World stock market Index) fell by 25% in less than a month in February and March 2020.

- In general, bonds have a low or negative correlation – i.e., moving differently to equities, particularly in extreme equity markets. This can help smooth a portfolio’s return journey. Whilst this is usually true there are some examples in the last 100 years of when bonds have fallen at the same time as equities, connected to a surge in inflation, such as we saw last year.

- Bonds provide a source of liquidity from which portfolio withdrawals can be made at times of equity market extremes, without the need to sell equities.

- Bonds have a higher expected return than holding cash and today, short-dated bond yields are higher than cash yields. Attempting to time when to jump between cash and bonds is not a game that long-term investors should play, as bond prices already incorporate all forward-looking views of what the future might hold, not least where the market thinks yields should be. Attempting to time bond investments is not a sound investment strategy as it will be entirely based on guess work.

Short-dated high quality bonds

With interest rates having risen substantially in a short period and the possibility of falling interest rates if the expected recession occurs, we are often asked whether this might be a good time to buy longer duration bonds to participate in the higher yields they offer and the improvement in bond prices if rates do start to fall.

Generally, we are expecting the growth part of the portfolio to generate the majority of long-term returns. While some expected returns should be higher in bond investments by taking on extra duration risk, it would usually be more efficient, to use this additional risk in the growth part of the portfolio. The same goes for credit risk where bonds with lower credit ratings generally offer higher yields. The defensive assets in our view should remain lower risk and we should avoid the temptation to try and eke out small additional returns from higher risk longer duration and lower credit quality bonds. It is important we retain the defensive characteristics in this part of the portfolio as it gives us the reassurance to take on equity risk.