Savings rates

Despite recent increases, interest rates remain significantly below inflation.

7th July 2023

-

Gavin Jones See profile

With the UK Bank Base Rate increasing again in June with a 0.5% increase to 5%, deposit rates continue to increase. You should check the rate on any savings accounts with high street banks however as these are now much lower than market rates. While having a small amount in these accounts for convenience may be fine, you could be losing out on interest if you have more substantial deposits with them.

National Savings has just announced an increase in some of its interest rates with the prize pot for Premium Bonds increasing to 4% tax free from the August draw.

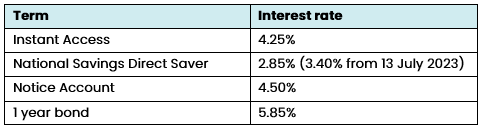

Looking at rates at the time of writing (on Monday 3 July) an indicative sample of the rates you can secure at present are as follows:

Source: Moneyfacts.co.uk 03.07.23

There is also some cash held in portfolios for the purpose of paying fees and the rate for this cash is currently 3.79%, which while not the very best rate available is competitive.

We have not included institutions in the table above as rates change quickly. If you wish to review the interest rates you are getting currently, please do speak to your financial planner.