A guide to cashflow forecasting: What it is & why you need it

8th October 2021

-

Jonathan Orchard See profile

The famous quote by Benjamin Franklin ‘If you fail to plan, you are planning to fail’, is so true in the context of managing personal finances.

Cashflow forecasting is often the unsung hero of financial planning for your future. It is sometimes misunderstood as an unreliable planning tool, and while the future is uncertain, cashflow forecasting has several important advantages that can help you save money, plan better or even give you a license to spend more frivolously in your later years!

With that in mind here we explain what cashflow forecasting is, the advantages, the misconceptions and how it can help you plan for a better financial future.

Simply investing money for the future is not planning, no matter how great the investment is or how much tax is being saved (although these are important in their own right). Proper financial planning is taking a step back and looking to the future, with the aim of making better decisions in the here and now. This ends up with the creation of a bespoke long term, robust and reviewable financial plan.

A key part of creating a personal financial plan is the use of cashflow forecasting. Your cash flows demonstrate that (based on certain assumptions) your longer-term plan can be met and you (and your spouse if applicable) will be financially secure should something happen to either of you.

‘I am certain I have more than enough capital wealth and income for my lifetime, so why do I need this confirming via a cashflow forecast?’

This is perhaps one of the most common questions and one that can have a variety of answers. It is always pleasing to hear that someone feels financially secure, but it can sometimes lead to more searching questions.

Death of a partner

Some people may not have considered how their financial situation could change in the unfortunate event of the death of one spouse or partner. It can be that one spouse has the majority share of income, which comfortably covers expenditure now, but on death this could be materially lower. Factoring in these types of scenarios with the help of cashflow forecasting, allows us to understand contingency planning much better and plan to hopefully avoid any sudden financial shocks.

Building up an Inheritance Tax bill

There are other scenarios that cashflow forecasting can help with. If someone is accruing wealth or already has significant capital assets (e.g. items such as investments, properties, cars, or even art), they could be building up a material Inheritance Tax liability in the future. This may look manageable in the present, but we can find that when you roll forward individuals’ financial situation over time, the liability could be increasingly significant.

In these circumstances, longer term cashflow forecasting can give individuals peace of mind and reassurance to plan for Inheritance Tax much earlier than they would expect.

Gifting is often a key part of Inheritance Tax planning but often people are concerned about the affordability of giving capital away and no longer having access to the funds. This can lead to gifts being left too late to secure any Inheritance Tax savings.

Cashflow modelling can highlight the affordability of gifts and provide reassurance that funds can be given away sooner without undermining your long-term financial security. Aside from the increased likelihood of saving Inheritance Tax, the family, for example, may receive much needed funds at a key point in their lives.

Enjoy yourself whilst you can

Whilst generally many people are financially secure, they still sometimes underestimate how positive their position is and therefore lack the confidence to ‘go for it’ with their expenditure (if they wanted to) now. There have been a number of instances where through the comfort of cashflow forecasting, clients have upgraded to premium (or even first class) flights, upgraded hotel rooms, or even paid for family members to join them on holiday for example. An important role for a financial planner is to encourage our clients to enjoy their money and not simply invest it!

Finally, we have seen that individuals generally are happier to spend more in the early years of retirement when healthy if they have greater visibility through cashflow forecasting that this additional expenditure will not undermine their longer-term financial situation. This helps balance the ‘enjoy yourself whilst you can’ philosophy of life with the need to also plan for the future.

‘Why do I need to know how much I spend? I just want you to look after my investments.’

Investing without any idea of your longer-term financial position is like starting a car journey but with no destination in mind. You do not know how far you must drive, thus how much fuel in the tank you need and how long it will take.

The same can be said of investing. If you do not take the time and effort first to construct a robust long term financial plan (with the aid of cashflow forecasting), how can you be sure for example what level of investment return you need to meet your longer-term requirements when you may need to draw on your investments and importantly the level of investment risk you need to take?

We often start with the view of what is the lowest level of investment risk you can take based on your potential longer-term position and expenditure requirements. This is exactly what cashflow forecasting helps us understand. Why would you wish to take a high investment risk approach (and the short-term volatility this can bring), if you only need a couple of percentage points over inflation growth each year to be financially secure for the rest of your life? Of course, this does not consider your tolerance to risk and return expectations, which could say something different.

By identifying how much money you need to spend now, and in the future, and forecasting the affordability of this long term, we are able to assess the suitability of your investments to support your lifestyle usually for the rest of your life.

‘The cashflows are not going to be very accurate given you are trying to forecast the future?’

There is of course a high degree of truth to this question; no one has a crystal ball and the future is always uncertain. However, the purpose of cashflow forecasting is not to forecast the future but simply to help plan for the future as prudently as possible.

We are essentially looking for general ‘trends’ in a client’s potential future wealth, i.e., is their wealth likely to go up or down over time based on certain assumptions and scenarios and at what rate. The exact monetary figures in some respects are less important as of course ten years from now we will never know to the penny how much someone will have.

The assumptions we make in terms of potential growth of capital assets and inflation are based on historical averages going back a significant number of years. We are confident therefore that we are using representative and realistic assumptions that help to paint a realistic picture of the future.

‘I’m too long away from retirement to plan this far into the future and I have no idea when I want to retire. Therefore, isn’t it a waste of time?’

Clearly, the longer we forecast into the future, the more variable any outcomes will be. For someone in their 30’s or 40’s, their financial and personal position is likely to change quite materially up until retirement (and beyond).

However, even at those ages, it is still valuable to take a step back and have an ‘educated guess’ at what the future could bring. It also can add some peace of mind, as cashflows will show the cumulative effect of saving at a young age, which perhaps is hard to visualise in the present.

Cashflow forecasting can also be used to better analyse key life events (not just retirement), which generally occur at a younger age. These could be the potential ability to fund private school fees, or the longer-term effects of taking on a larger mortgage, for example.

Will a cashflow forecast help me understand my pension plan?

With pension planning having become more complicated in the last few years as it is no longer necessary to buy an annuity we can look at when pensions will need to be accessed.

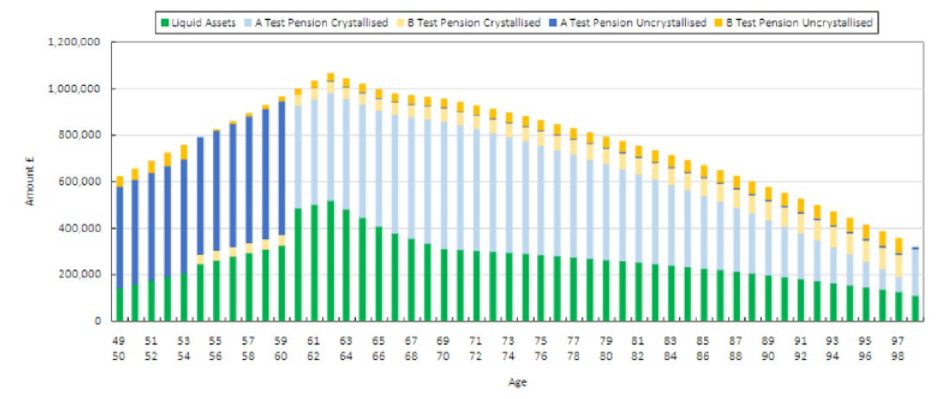

The chart below for a test client shows in particular A Test’s pension going from Uncrystallised to Crystallised – This is pension terminology for drawing the tax-free lump sum and being able to take ongoing income. The amount of assets in savings (liquid assets i.e. cash) and pensions are calculated each year and the forecast shows that the couple should have enough money to meet their expected expenditure if they live to their 99th birthday.

The final key point is that the creation of a financial plan is not a one-off exercise as it should always be a ‘work in progress’ and cashflow forecasting equally should be reviewed and adapted every year. Just as we adapt to life’s changes, financial plans need to adapt as well.

In our experience, these are some of the key benefits we have seen from cashflow forecasting:

- Financial security – What do you need to do to secure your financial future?

- Provides a sense of purpose and motivation – What are you working so hard for and why are you saving?

- Less guilt – Can you afford to spend now without impacting on your future?

- More time/choice – Could you retire early or start to work part time?

- Taking the right amount of risk – Are you taking unnecessary investment risks to maintain your lifestyle?

- Providing for the younger family generations earlier

- Prioritizing what is important

- Making sound lifestyle and financial choices

- Peace of mind – Understanding where you are today and where you are going. Are you going to have enough or too much money?

To find out more about what we can do to help with your financial planning, get in touch.